91 | Add to Reading ListSource URL: cdn1.xamarin.comLanguage: English - Date: 2014-12-19 16:56:42

|

|---|

92 | Add to Reading ListSource URL: ec.europa.euLanguage: English - Date: 2015-01-22 11:04:17

|

|---|

93 | Add to Reading ListSource URL: www.parlament.gv.atLanguage: English - Date: 2014-09-17 07:51:42

|

|---|

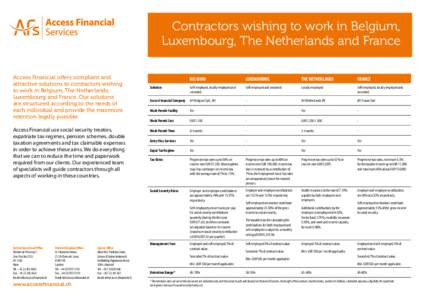

94 | Add to Reading ListSource URL: www.accessfinancial.chLanguage: English - Date: 2013-04-29 06:39:48

|

|---|

95 | Add to Reading ListSource URL: www.oecd.orgLanguage: English - Date: 2014-07-21 01:58:12

|

|---|

96![Revenue Statistics[removed]Switzerland Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Switzerland increased by 0.2 percentage points from 26.9% to 27.1% in[removed]The corres Revenue Statistics[removed]Switzerland Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Switzerland increased by 0.2 percentage points from 26.9% to 27.1% in[removed]The corres](https://www.pdfsearch.io/img/fe6c48a436280f5c696376c1e31d0b18.jpg) | Add to Reading ListSource URL: oecd.orgLanguage: English - Date: 2014-12-09 17:22:04

|

|---|

97![Revenue Statistics[removed]Luxembourg Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Luxembourg increased by 0.8 percentage points from 38.5% to 39.3% in[removed]The correspo Revenue Statistics[removed]Luxembourg Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Luxembourg increased by 0.8 percentage points from 38.5% to 39.3% in[removed]The correspo](https://www.pdfsearch.io/img/bd71d6382b26168685d779d07d4aeb02.jpg) | Add to Reading ListSource URL: oecd.orgLanguage: English - Date: 2014-12-09 17:22:07

|

|---|

98![Revenue Statistics[removed]France Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in France increased by 1 percentage point from 44.0% to 45.0% in[removed]The corresponding figur Revenue Statistics[removed]France Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in France increased by 1 percentage point from 44.0% to 45.0% in[removed]The corresponding figur](https://www.pdfsearch.io/img/83d4151ad9802e429a756213537343ee.jpg) | Add to Reading ListSource URL: oecd.orgLanguage: English - Date: 2014-12-09 17:22:05

|

|---|

99![Revenue Statistics[removed]Mexico Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Mexico increased by 0.1 percentage points from 19.5% to[removed]% in[removed]The corresponding Revenue Statistics[removed]Mexico Tax burden over time The OECD’s annual Revenue Statistics report found that the tax burden in Mexico increased by 0.1 percentage points from 19.5% to[removed]% in[removed]The corresponding](https://www.pdfsearch.io/img/2b40a9536ef3713aa5d1b675682c54e5.jpg) | Add to Reading ListSource URL: oecd.orgLanguage: English - Date: 2014-12-09 17:22:04

|

|---|

100![Unclassified ECO/WKP[removed]Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development Unclassified ECO/WKP[removed]Organisation de Coopération et de Développement Economiques Organisation for Economic Co-operation and Development](https://www.pdfsearch.io/img/74d9297055167c7bfeae3ed3e291748a.jpg) | Add to Reading ListSource URL: www.oecd.orgLanguage: English - Date: 2014-07-04 12:32:16

|

|---|